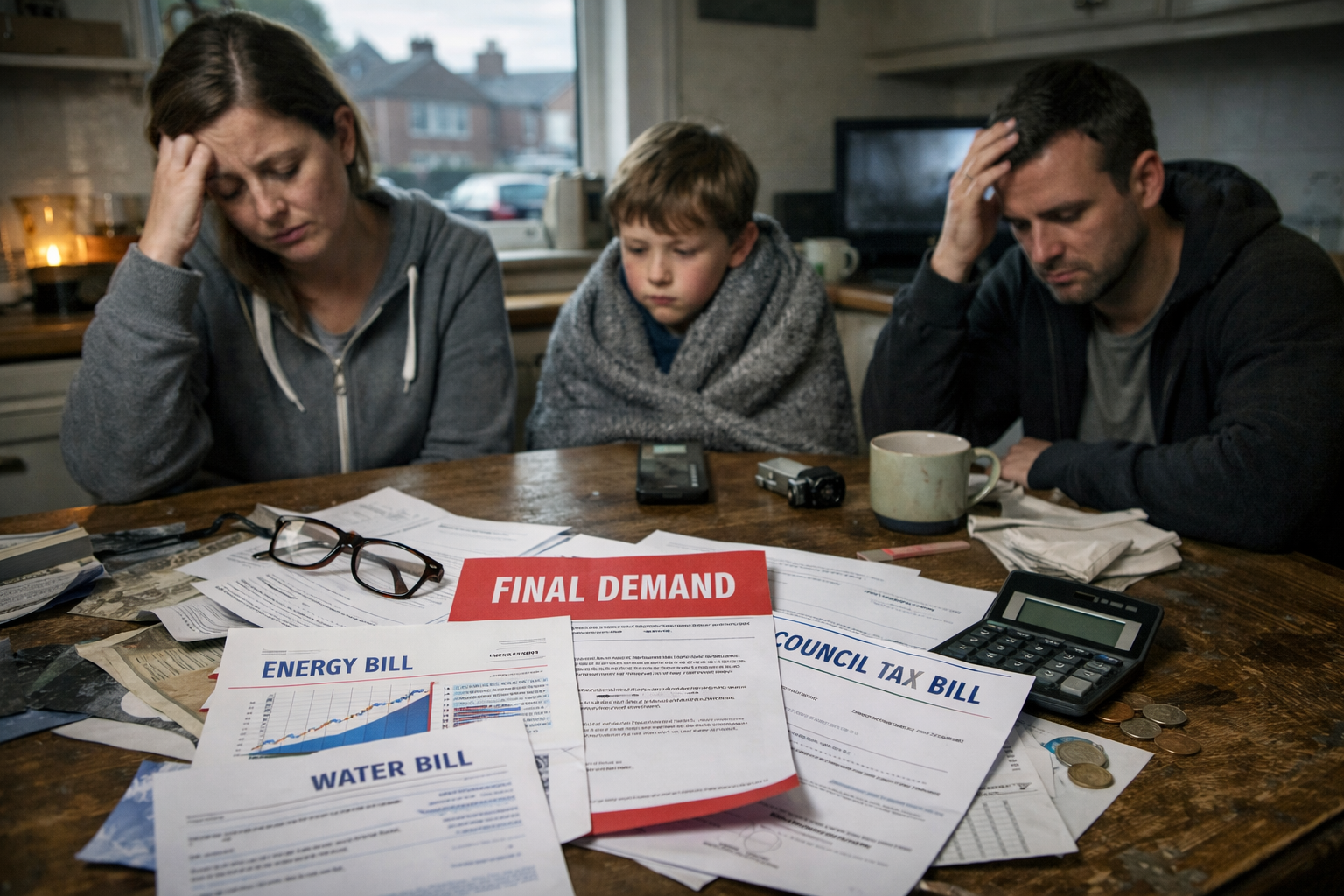

Bills Bite Hard as Families Face a Relentless Year of Rising Costs

Households have endured a tough year as widespread price rises from energy to council tax have left many struggling to keep their finances on track.

This year’s so-called “Awful April” increases, combined with persistently high energy costs, pushed the average household to absorb an extra £1,254 a year in essential bills, according to figures from comparison site Uswitch.

Council tax rose by 5% in most areas of England the maximum allowed with some councils, including Birmingham, Bradford, Newham, Somerset, Trafford, and Windsor & Maidenhead, given special permission to raise bills even further.

Water bills increased by an average of £123 per year, marking the largest rise since the industry was privatised in 1989. Broadband and phone bills also climbed, while the cost of a TV licence and the standard rate of car tax both rose by £5 with electric vehicles no longer exempt.

Energy costs have remained a major pressure point. Ofgem’s energy price cap, which applies to households on standard variable tariffs rather than fixed deals, began the year at £1,738 for the average household and is set to end it at £1,755, before rising again to £1,758 on January 1.

Uswitch spokeswoman Sabrina Hoque said pressure on households has been widespread. Energy debt reached an eight-year high in October, with households owing £780 million to suppliers. She added that more than two million homes say they will not turn on their heating this winter a fifth more than last year.

Mobile and broadband costs have also caused concern, with average annual increases of £21.99 for broadband and £15.90 for mobile contracts. In recent months, almost every major provider has announced updated price rise rates for new customers, with some monthly increases reaching as much as £4.

Ms Hoque warned that many broadband and mobile bills are set to rise again in April 2026. She advised customers who are out of contract, or whose deals expire before then, to consider switching, noting that out-of-contract rates are usually more expensive and that households could save an average of £203 a year by moving to a new broadband deal.

Citizens Advice chief executive Dame Clare Moriarty said the cost-of-living crisis is far from over. She highlighted that four million people are now in a negative budget, meaning they cannot afford essentials such as energy bills, rent, or food.

She said advisers see the impact of these rising costs daily, with many people feeling they are constantly struggling to stay afloat but slipping further into debt despite their best efforts.

Dame Clare stressed that everyone should be able to afford the basics, calling for better targeted support. She urged the Government to increase Local Housing Allowance to help those struggling with rent and to improve bill support so that high utility costs particularly energy and water do not continue to push household budgets beyond breaking point.